In today’s fast-paced world, the insurance industry faces significant challenges and opportunities. The integration of digital technologies and analytics is revolutionizing how insurers operate. This transformation enhances efficiency, improves customer experiences, and helps manage risks effectively. This article delves into the various facets of digital transformation in insurance, outlining its importance, benefits, and future trends.

Digital Transformation in Insurance

Digital transformation in insurance is not just about adopting new technologies; it’s about reshaping the entire industry. Traditional insurance practices are being challenged by digital innovations. Companies are leveraging technology to enhance operational efficiency and improve customer interactions.

Insurers are increasingly focusing on customer-centric approaches. This shift allows them to deliver tailored services that meet the evolving needs of their policyholders. The digital landscape is enabling insurers to operate more flexibly and responsively.

Key Statistics

- 60% of insurance leaders prioritize digital transformation initiatives.

- 70% of customers expect personalized experiences from their insurers.

Role of Analytics in Insurance

Analytics is at the heart of modern insurance practices. It empowers insurers to make informed decisions by converting data into actionable insights. By utilizing advanced analytical tools, companies can improve underwriting, pricing, and claims management processes.

The role of analytics extends beyond operational efficiency. It also enhances risk management by identifying emerging trends and potential threats. Insurers can assess risk more accurately, leading to better pricing strategies and improved profitability.

Analytics Overview

| Aspect | Impact |

|---|---|

| Decision-Making | Improved accuracy in assessments |

| Risk Management | Enhanced ability to identify potential threats |

The Benefits of Digital and Analytics in Insurance

The integration of digital tools and analytics provides numerous benefits for the insurance sector. Companies can achieve greater efficiency, better decision-making, and enhanced customer satisfaction.

- Operational Efficiency: Automation reduces costs and streamlines processes.

- Data-Driven Insights: Analytics facilitates smarter decisions based on factual data.

- Customer Engagement: Personalized experiences lead to improved customer loyalty.

Benefits Summary

- Increased Productivity: Digital tools enable quicker task completion.

- Cost Reduction: Streamlined operations lower operational expenses.

Enhancing Underwriting with Digital and Analytics

Underwriting is a critical function in the insurance industry. Digital transformation and analytics significantly enhance this process. Insurers can automate underwriting tasks, analyze larger datasets, and make more accurate decisions.

Predictive analytics models help assess risks more precisely. This leads to better pricing strategies and reduced exposure to potential losses. By integrating digital tools, insurers can operate more efficiently and effectively.

Underwriting Benefits

- Faster Processing Times: Automation speeds up decisions.

- Improved Risk Assessment: Data-driven insights enhance accuracy.

Data-Driven Pricing Models

Pricing models in insurance are evolving thanks to digital tools. Traditional methods relied heavily on historical data, while modern approaches incorporate real-time information. This shift allows for personalized pricing based on individual behaviors and risk profiles.

Data-driven pricing models help insurers align their offers more closely with actual risks. This strategy leads to improved profitability and customer satisfaction.

Pricing Model Statistics

- 45% of insurers report improved pricing accuracy with data analytics.

- Personalized pricing can increase customer retention by 20%.

Improving Claims Processing Through Automation

Claims processing is another area where digital transformation is having a profound impact. Automation in this process reduces human error and accelerates the claims settlement timeline. Insurers can provide faster payouts, enhancing the overall customer experience.

Machine learning algorithms can analyze claims data more effectively. This leads to quicker resolutions and improved accuracy in damage assessments.

Claims Processing Overview

| Benefit | Description |

|---|---|

| Faster Resolutions | Reduced claim processing time |

| Lower Operational Costs | Automation decreases overall expenses |

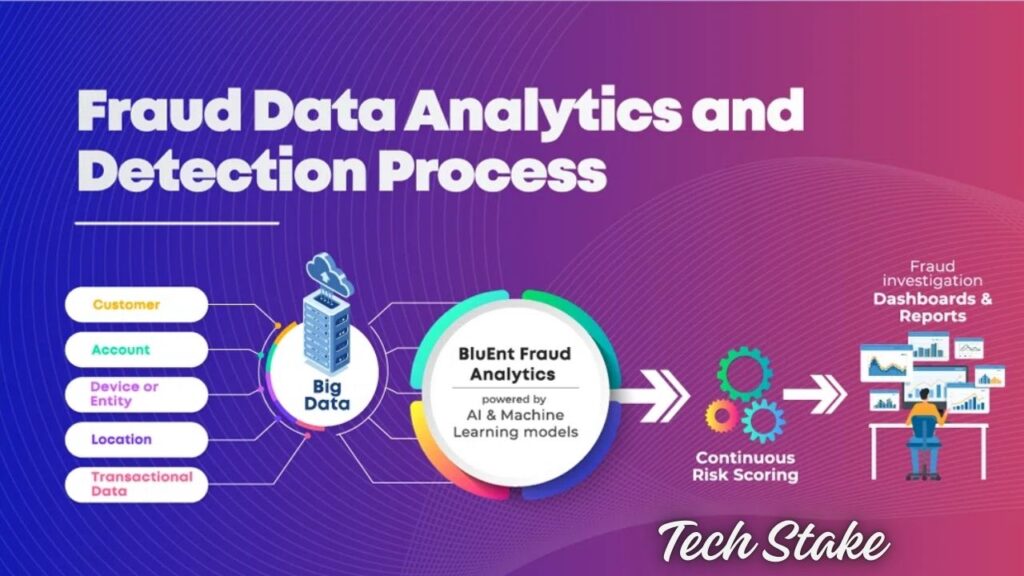

Fraud Detection with Analytics

Fraud is a persistent challenge in the insurance industry. Analytics plays a crucial role in combating this issue. By leveraging data analysis, insurers can detect fraudulent claims more effectively.

Advanced algorithms identify suspicious patterns within large datasets. This proactive approach not only reduces losses but also protects honest policyholders.

Fraud Detection Benefits

- Increased Accuracy: Machine learning improves detection rates.

- Reduced Losses: Early identification minimizes financial impacts.

Customer Experience Enhancement

In the digital age, customer experience is paramount. Insurers are increasingly adopting digital platforms, mobile apps, and self-service portals to enhance customer interactions. These tools provide seamless experiences and empower customers to manage their policies conveniently.

Analytics is critical in predicting customer needs, allowing companies to tailor their offerings. Personalized communication leads to higher customer satisfaction and loyalty.

Customer Experience Statistics

- 80% of consumers prefer to engage with brands that offer personalized experiences.

- Companies focusing on customer experience can increase retention by 10%.

The Role of Artificial Intelligence (AI) in Insurance

AI is transforming the insurance landscape by automating processes and analyzing vast amounts of data. This technology improves efficiency and decision-making across various operations.

From underwriting to claims management, AI enhances accuracy and speeds up processes. AI-driven chatbots also provide instant customer support, improving overall service quality.

AI Impact Overview

| Area | Impact |

|---|---|

| Underwriting | Faster and more accurate risk assessments |

| Claims Management | Quicker resolution times and enhanced accuracy |

The Importance of Cloud Computing

Cloud computing is foundational to digital transformation in insurance. It provides scalable, secure, and cost-effective solutions. Insurers can store and analyze large volumes of data in real-time, enabling quicker decision-making.

The cloud also facilitates collaboration among teams, improving overall productivity. As insurers continue to modernize, cloud technology will play an increasingly vital role.

Cloud Computing Benefits

- Scalability: Easily adapt to growing data needs.

- Cost-Effectiveness: Reduces IT expenses significantly.

Integrating Internet of Things (IoT) into Insurance

The Internet of Things (IoT) refers to interconnected devices that communicate and share data. In insurance, IoT can provide real-time insights into risk profiles. For example, connected vehicles can monitor driving behavior, allowing insurers to offer personalized premiums.

By leveraging IoT data, insurers can improve their pricing models and enhance claims management. This integration leads to more accurate assessments and better customer experiences.

IoT Impact Overview

| Application | Benefits |

|---|---|

| Connected Vehicles | Real-time data collection for personalized pricing |

| Smart Home Devices | Enhanced risk assessment and monitoring |

Blockchain Technology in Insurance

Blockchain technology is gaining traction in the insurance industry. It offers secure, transparent, and immutable records of transactions. This technology simplifies tracking policies, claims, and payments, reducing fraud and enhancing trust.

Blockchain can also streamline processes such as reinsurance, minimizing complexity and costs. As insurers explore these innovations, blockchain will likely play a significant role in future operations.

Blockchain Benefits

- Transparency: Immutable records enhance trust.

- Efficiency: Reduces the complexity of transactions.

Data Privacy and Security Challenges

While digital transformation offers numerous benefits, it also presents challenges related to data privacy and security. Insurers handle vast amounts of sensitive customer data, making them attractive targets for cyber threats.

Implementing strong cybersecurity measures and adhering to data privacy regulations are essential for maintaining customer trust. Insurers must prioritize data protection in their digital strategies.

Data Privacy Statistics

- 30% of consumers are concerned about data privacy when purchasing insurance.

- Companies investing in cybersecurity can reduce breaches by 40%.

Customer-Centric Digital Insurance Platforms

The shift towards digital platforms empowers customers to manage their insurance experiences. Through mobile apps and online portals, customers can easily access information, submit claims, and manage policies.

This transition has made insurance processes more transparent and user-friendly. By focusing on customer needs, insurers can enhance satisfaction and loyalty.

Digital Platform Benefits

- Accessibility: Customers can manage policies anytime, anywhere.

- Transparency: Clear information improves trust.

Predictive Analytics in Risk Management

Predictive analytics allows insurers to identify emerging risks and trends before they manifest. By analyzing historical data, companies can forecast future outcomes and make proactive decisions.

This capability is particularly valuable for managing underwriting risks, pricing models, and claims forecasting. Insurers can stay ahead of potential challenges, improving overall risk management.

Predictive Analytics Impact

| Benefit | Description |

|---|---|

| Early Risk Identification | Proactive management of potential issues |

| Improved Decision-Making | Data-driven insights enhance accuracy |

The Rise of Insurtech

Insurtech, a blend of insurance and technology, refers to startups and companies that leverage technology to disrupt traditional models. These firms are often at the forefront of digital transformation in the industry, developing innovative solutions using AI, blockchain, and other technologies.

Insurtech is reshaping the insurance landscape by offering new products and services that challenge established insurers. This competition drives innovation and improves customer experiences.

Insurtech Statistics

- 50% of consumers are open to using insurtech solutions.

- Insurtech investments reached $10 billion in the last year alone.

The Impact of Big Data on Insurance

Big data is revolutionizing how insurance companies collect, analyze, and utilize information. By harnessing big data, insurers gain deeper insights into customer behavior, market trends, and risk management.

This data-driven approach helps insurers make informed decisions, improve operational efficiencies, and personalize customer offerings. Big data is a game-changer in the insurance industry.

Big Data Benefits

- Enhanced Insights: Better understanding of customer needs.

- Operational Improvements: Streamlined processes and reduced costs.

READ THIS BLOG ALSO : Blog Home Ideas: TheHomeTrotters Inspiration for Every Corner of Your Space

Real-Time Data Analytics in Insurance

Real-time data analytics is transforming how insurers assess risk and process claims. With immediate access to data, insurers can adjust their models based on changing circumstances.

This capability improves decision-making and enhances the customer experience. Insurers can provide timely information and respond more effectively to customer needs.

Real-Time Analytics Overview

| Advantage | Description |

|---|---|

| Immediate Insights | Quick access to critical data for decision-making |

| Enhanced Responsiveness | Ability to adapt to market changes rapidly |

Digital Transformation Strategies for Insurers

To successfully implement digital and analytics strategies, insurers need a comprehensive approach. This includes leadership commitment, technological investment, and a focus on innovation.

Digital transformation strategies should prioritize customer needs and streamline internal operations. Insurers must also invest in employee training to effectively leverage new technologies.

Strategy Overview

- Leadership Commitment: Strong support is crucial for successful implementation.

- Technological Investment: Allocate resources for modern tools and systems.

Overcoming Challenges in Digital Adoption

While digital adoption offers significant benefits, challenges exist. Resistance to change, legacy systems, and regulatory hurdles can hinder progress. Insurers must take a strategic approach to overcome these barriers.

Engaging stakeholders, investing in modern technology, and ensuring teams are prepared for the digital shift are essential steps. By addressing these challenges, insurers can successfully navigate the digital landscape.

Challenges Overview

| Challenge | Description |

|---|---|

| Resistance to Change | Employees may be hesitant to adopt new technologies |

| Legacy Systems | Outdated systems can complicate integration |

The Future of Digital and Analytics in Insurance

The future of digital and analytics in insurance looks promising. As technology continues to evolve, insurers will have access to even more advanced tools and capabilities. Automation, AI, blockchain, and IoT will play increasingly important roles in shaping the industry.

Insurers that embrace these technologies and adapt to changing customer expectations will be well-positioned to thrive in the digital era. The future of insurance is about being agile, customer-centric, and data-driven.

Future Trends

- Increased use of AI and machine learning for decision-making.

- Growing reliance on real-time data for risk assessment and pricing.

Common Questions and Solutions

What is digital transformation in insurance?

Digital transformation involves integrating digital technologies to enhance operations, improve customer experiences, and streamline processes.

How does analytics improve underwriting?

Analytics enables insurers to assess risks more accurately, leading to better pricing and decision-making.

What are the benefits of using AI in insurance?

AI automates processes, analyzes data, and enhances decision-making, improving efficiency and customer service.

Why is data privacy important in insurance?

Data privacy is crucial for protecting sensitive customer information and maintaining trust in the insurance industry.

Final Words

In conclusion, the integration of digital technologies and analytics in insurance is essential for enhancing operational efficiency, improving customer experiences, and managing risks effectively. As the industry continues to evolve, insurers must embrace innovation and leverage data to drive their success.

The future of insurance is bright, with immense potential for growth and transformation. By prioritizing customer needs and adopting advanced technologies, insurers can create a more agile and responsive ecosystem.

SEO expert focused on boosting online visibility and driving organic traffic. Passionate about data analysis, strategy, and the latest digital marketing trends.