Business loans are vital for entrepreneurial growth. They empower business owners to turn their ambitions into reality. In this article, we explore how to capitalize on ambition using business loans strategically.

The Role of Capitalizing on Ambition: A Holistic View of Business Loans and Prosperity Business Success

Ambition drives business success. It inspires entrepreneurs to innovate and expand. However, without financial resources, ambition can stall. Business loans provide essential funding to transform ideas into reality. They are not just quick fixes but integral parts of a holistic financial strategy.

Key Points:

- Ambition shapes business goals.

- Loans enable growth and innovation.

- Financial stability supports long-term success.

Understanding Business Loans: The Basics

Business loans are financial products designed to help companies meet their funding needs. They can cover various expenses, from operational costs to market expansion initiatives. Understanding the basics is crucial for making informed decisions.

Key Types of Loans:

- Term Loans: Lump-sum payments for long-term investments.

- Lines of Credit: Flexible borrowing options for immediate costs.

- SBA Loans: Government-backed loans with favorable terms.

Different Types of Business Loans and Their Benefits

Understanding the different loan types is essential for entrepreneurs. Each type serves unique business needs.

Term Loans

- Benefits: Ideal for large purchases; fixed interest rates.

Lines of Credit

- Benefits: Offers flexibility; useful for cash flow management.

SBA Loans

- Benefits: Lower interest rates; longer repayment terms.

Invoice Financing

- Benefits: Immediate cash flow; reduces payment waiting times.

Merchant Cash Advances

- Benefits: Quick access to funds; based on future sales.

Comparison of Loan Types

| Loan Type | Benefits | Ideal Use |

|---|---|---|

| Term Loans | Fixed rates, long-term investment | Equipment purchases |

| Lines of Credit | Flexible, on-demand access | Cash flow management |

| SBA Loans | Low rates, long terms | Startups and small businesses |

| Invoice Financing | Fast cash; improves cash flow | Short-term liquidity |

| Merchant Cash Advances | Quick cash; future sales based | Immediate operational needs |

How Business Loans Can Fuel Ambition?

Business loans provide the capital needed to pursue ambitious goals. They enable entrepreneurs to invest in innovation funding, enhance operational efficiency, and expand their market reach. By leveraging loans, businesses can turn aspirations into achievements.

Key Benefits:

- Capital for Growth: Loans allow for expansion and innovation.

- Risk Management: Properly used, loans can mitigate risks in cash flow.

Strategic Use of Business Loans for Business Growth

Using loans strategically is crucial for sustainable growth. Entrepreneurs should align their loan usage with their long-term goals.

Strategies:

- Allocate loans for investments that yield high return on investment (ROI).

- Use funds to enter new markets and enhance product offerings.

Bullet Points:

- Invest in technology investments for operational efficiency.

- Focus on marketing initiatives to increase market reach.

Maintaining a Healthy Balance Between Debt and Equity

Balancing debt and equity is essential for financial health. Over-reliance on debt can strain a business, while excessive equity can dilute ownership.

Key Considerations:

- Debt-to-Equity Ratio: Maintain a healthy ratio to ensure stability.

- Financial Planning: Regular assessments can prevent over-leverage.

The Importance of Financial Planning and Forecasting

Effective financial planning is vital for leveraging business loans. Entrepreneurs must assess their financial health and forecast future cash flows accurately.

Steps to Take:

- Evaluate current financial status and creditworthiness.

- Prepare for potential market fluctuations through detailed forecasting.

How Creditworthiness Affects Loan Eligibility?

Lenders assess creditworthiness before approving loans. A strong credit profile can yield better loan terms.

Key Factors:

- Credit Score: Higher scores improve loan eligibility.

- Financial History: A solid repayment history increases trust.

The Impact of Interest Rates on Loan Repayments

Interest rates significantly influence loan costs. Understanding how they work is crucial for managing repayments effectively.

Key Insights:

- Lower rates reduce the overall cost of borrowing.

- Fixed rates offer predictability in repayment schedules.

Loan Terms and Repayment Schedules: What to Consider

Choosing the right loan terms and repayment schedules can impact your business’s cash flow.

Factors to Consider:

- Long vs. short-term loans: Assess your cash flow needs.

- Monthly obligations: Ensure they align with your revenue streams.

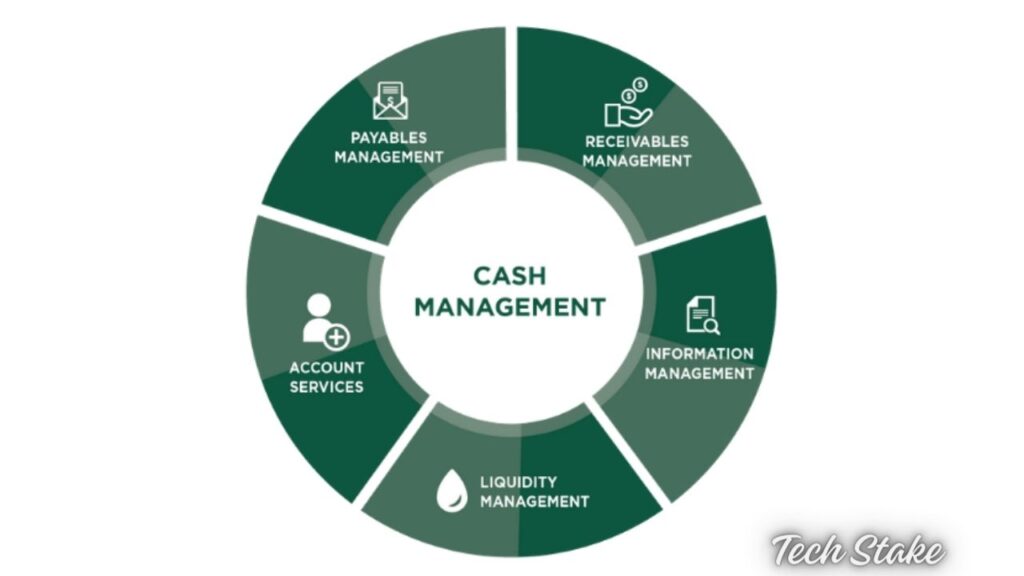

How Business Loans Support Cash Flow Management?

Effective cash flow management is critical for business sustainability. Loans provide the liquidity needed to cover operational expenses.

Benefits:

- Smooth out cash flow fluctuations.

- Ensure timely payments to suppliers and employees.

Leveraging Loans to Invest in Innovation and Technology

Investing in technology can drive competitive advantage. Business loans can fund these critical investments.

Key Areas for Investment:

- Research and development.

- Upgrading existing systems.

The Role of Business Loans in Expanding Market Reach

Expanding into new markets requires capital. Business loans can help cover the costs of marketing and distribution.

Strategies:

- Develop targeted marketing campaigns.

- Allocate funds for market research.

Navigating the Risks Associated with Business Loans

While loans provide opportunities, they also carry risks. Entrepreneurs must navigate these effectively.

Common Risks:

- Over-leveraging can lead to financial strain.

- Mishandling cash flow can jeopardize loan repayments.

Alternative Financing Options for Ambitious Entrepreneurs

Exploring alternative financing options can provide additional capital sources. Options include crowdfunding and angel investors.

Key Points:

- Each alternative has its own advantages and challenges.

- Assess which option aligns best with your business goals.

Building Relationships with Lenders and Investors

Strong relationships with lenders and investors can facilitate future financing opportunities. Communication and trust are key.

Strategies:

- Maintain transparency in financial reporting.

- Engage regularly with financial partners.

READ THIS BLOG ALSO : Understanding Sources Klarna, Jacobsson, and Ipotimes

How Business Loans Facilitate Expansion and Acquisition

Loans can finance acquisitions, accelerating growth. They provide leverage for businesses looking to expand their operations.

Key Benefits:

- Gain market share quickly.

- Access new customer bases.

Capitalizing on Ambition: A Long-Term Approach to Prosperity

To truly capitalize on ambition, a long-term perspective is essential. Sustainable growth strategies should be prioritized over short-term gains.

Key Focus Areas:

- Reinvest profits back into the business.

- Continuously evaluate and adapt financial strategies.

The Psychological Aspect of Business Loans: Overcoming Fear and Hesitation

Taking on debt can be daunting. Understanding the benefits can help overcome psychological barriers.

Key Insights:

- Loans are investments in business growth.

- A solid plan can alleviate concerns about repayments.

Common Questions and Solutions

What types of business loans are available?

There are several loan types, including term loans, lines of credit, and SBA loans.

How does creditworthiness affect loan eligibility?

A strong credit profile increases the chances of securing favorable loan terms.

What should I consider when choosing a loan?

Evaluate interest rates, repayment schedules, and your business’s cash flow needs.

Final Words

Capitalizing on ambition through business loans requires a holistic approach. By understanding the various loan types and strategically utilizing them, entrepreneurs can achieve long-term prosperity.

Always focus on financial planning, maintain a healthy balance between debt and equity, and build strong relationships with lenders. With the right strategy, ambition can lead to success.

SEO expert focused on boosting online visibility and driving organic traffic. Passionate about data analysis, strategy, and the latest digital marketing trends.